Import-export heads in right direction

The Ministry of Industry and Trade (MoIT) this month reported to the government that Vietnam’s export landscape is remarkably recovering, with strong expectations for the months to come.

In the first half 2023, the country’s total export turnover hit $164.45 billion, down 12.1 per cent on-year, both in performance of Vietnamese and foreign exporters in the country.

However, the MoIT said, such a grey situation has completely changed in the first half of this year, when the figure is estimated to hit nearly $190.1 billion, up 14.5 per cent on-year. Domestically invested exporters’ reached $53.4 billion, up 20.6 per cent and holding 28.1 per cent of the country’s total export value. Foreign firms’ exports stood at $136.7 billion, up 12.3 per cent and responsible for 71.9 per cent.

In June, total export turnover is estimated to come at $33.1 billion, up 10.5 per cent on-month. Vietnamese exports hit $9.33 billion, up 16.6 per cent, and foreign businesses’ exports hit $23.76 billion, up 8.3 per cent.

In Q2 of 2024, total export turnover of the economy is estimated to reach $97.2 billion, up 12.5 per cent on-year and 4.6 per cent on-quarter.

Under the General Statistics Office’s Q2 survey on enterprises’ manufacturing and processing released two weeks ago, 34.6 per cent of respondents said their orders in Q2 were bigger than in Q1; some 44.3 of respondents said their Q2 orders were kept stable.

Meanwhile, in Q3 as compared to Q2, 38 per cent of surveyed enterprises said that they expect a rise in orders and 45.8 per cent predict stable orders, and only 16.2 per cent of respondents said they forecast a reduction in orders.

As for new export orders, in Q2 against Q1, 28.8 per cent confirmed a higher number of such orders; 49.6 said their new orders were kept stable. In Q3 versus Q2, 33.1 per cent of surveyed enterprises said they expect a rise in orders; and 50.6 per cent predict stable orders. Only 16.3 per cent of respondents said they project a decrease in export orders.

|

In an example, since early this year, Tan Viet Garment Co., Ltd. in Hanoi has been seeing a 10 per cent increase in export orders from Europe, which is responsible for about 40 per cent of its export value.

“We have been expanding our export markets to South Korea, ASEAN, and Japan, besides the European market. We are now also negotiating more export contracts for Q4 of 2024,” said Tam Viet representative Nguyen Hoang Huong. “Since early this year, we have also recruited more workers to fulfil the contracts on time.”

The company’s six-month export revenue is estimated to ascend 9-10 per cent on-year, which Huong said was positive in the context that the entire garment and textile industry is recovering on the back of rising demands in the global market.

The MoIT reported that in the first six months of this year, the industry reaped an export turnover of $16.3 billion, up 3.1 per cent on-year.

Vietnam National Textile and Garment Group also reported that though its six-month production and business results remain unavailable now, its five-month export turnover hit $16 billion, up 5 per cent on-year. Its member companies have had sufficient export orders until the end of Q3 of 2024, and they are now negotiating new orders for Q4.

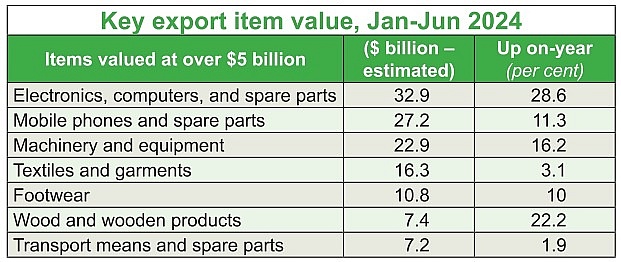

Moreover, according to the MoIT, another 28 export items also reaped an export turnover of more than $1 billion, accounting for 91.4 per cent of the country’s total export turnover, in which five items had an export turnover of over $5 billion, holding 65.6 per cent of total (see box).

Accumulatively in the first six months of this year, the Vietnamese economy’s total import and export turnover of goods is estimated to reach $368.53 billion, up 14.5 per cent on-year. In which the import value stood at $178.45 billion, an on-year rise of 17 per cent. The total trade surplus reached $11.63 billion.

However, though Vietnam’s export landscape is regaining momentum, it may continue facing some risks from now until the year’s end due to lingering challenges.

According to the MoIT, many developed countries and Vietnam’s key trade partners are paying more attention to sustainable development, coping with climate change, and safety for consumers. They are applying more stringent standards and regulations about supply chains, materials, labour, and environment to imported products.

Moreover, many nations have also been diversifying their supplies outside China, with focus placed on a number of partners near and similar to Vietnam such as Turkey, Mexico, India, Indonesia, and Bangladesh. This will increase competitiveness for Vietnam’s exports, the MoIT said.

According to the Asian Development Bank, softened global demand caused by slow economic recovery and continued geopolitical tensions would slow the full recovery of Vietnam’s export-led growth.

Vietnam’s imports and exports will grow modestly by 4-4.5 per cent this year and next as external demand gradually recovers. Renewed manufacturing activity would push up imports of production inputs, it explained.

Source: Vietnam Investment Review